Business, 09.04.2020 20:56 keishlav5183

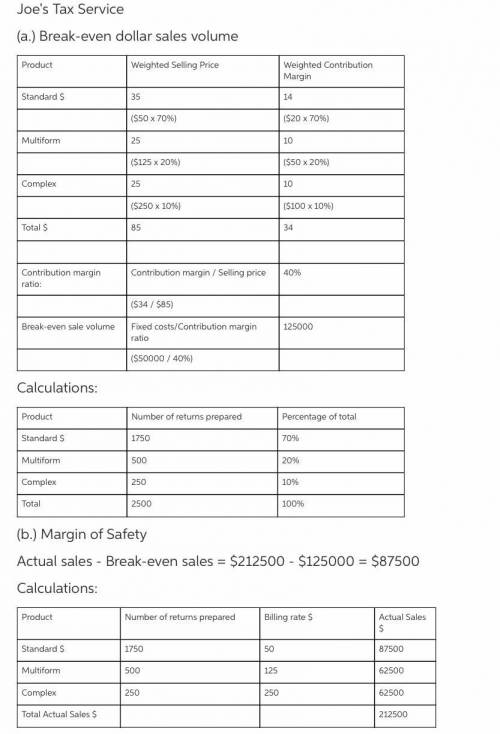

Joe's Tax Service prepares tax returns for low-to middle-income taxpayers. Its service operates January 2 through April 15 at a counter in a local grocery store. All jobs are classified into one of three categories: standard, multiform, and complex. Following is information for last year. Also, last year, the fixed cost of rent, utilities, and so forth were $55,000. Standard Multiform ComplexBilling rate $135 $260Average variable costs (30) (75) (150)Average contribution margin $30 $60 $110Number of returns prepared 1,750 500 250Required(a.) Determine Joe's break-even dollar sales volume.-Round contribution margin to three decimal places.-Round break-even sales volume to the nearest dollarProduct Weighted Selling Price Weighted Contribution MarginStandard Multiform Complex Total Contribution margin ratio:Break-even sales volume:(b.) Determine Joe's margin of safety in sales dollars. Round answer to the nearest whole number

Answers: 2

Another question on Business

Business, 22.06.2019 04:30

What is the second step in communication planning? determine the purpose of the message outline the communication for delivery determine the best channel of communication clarify objectives identify the audience

Answers: 2

Business, 22.06.2019 09:20

Which statement best explains the relationship between points a and b? a. consumption reaches its highest point, and then supply begins to fall. b. inflation reaches its highest point, and then the economy begins to expand. c. production reaches its highest point, and then the economy begins to contract. d. unemployment reaches its highest point, and then inflation begins to decrease.

Answers: 2

Business, 22.06.2019 12:30

howard, fine, & howard is an advertising agency. the firm uses an activity-based costing system to allocate overhead costs to its services. information about the firm's activity cost pool rates follows: stooge company was a client of howard, fine, & howard. recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the stooge company account. using the activity-based costing system, how much overhead cost would be allocated to the stooge company account?

Answers: 1

Business, 22.06.2019 13:40

A.j. was a newly hired attorney for idle time gaming, inc. even though he reported directly to the president of the company, a.j. noticed that the president always had time to converse with the director of sales, calling on him to get a pulse on legal/regulatory issues that, as the company attorney, a.j. could have probably handled. a.j. also noted that the hr manager’s administrative assistant was the go-to person for a number of things that would make life easier at work. a.j. was recognizing the culture at idle time gaming.

Answers: 3

You know the right answer?

Joe's Tax Service prepares tax returns for low-to middle-income taxpayers. Its service operates Janu...

Questions

Health, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50

Mathematics, 04.02.2021 18:50