Business, 11.04.2020 03:03 dfrtgyuhijfghj3496

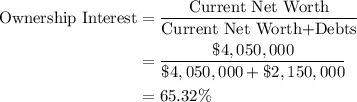

Tom Scott is the owner, president, and primary salesperson for Scott Manufacturing. Because of this, the company's profits are driven by the amount of work Tom does. If he works 40 hours each week, the company's EBIT will be $635,000 per year; if he works a 50 hour week, the company's EBIT will be $795,000 per year. The company is currently worth $4.05 million. The company needs a cash infusion of $2.15 million, and it can issue equity or issue debt with an interest rate of 7 percent. Assume there are no corporate taxes. a. What are the cash flows to Tom under each scenario? (Enter your answers in whole dollars, not millions of dollars. Do not round intermediate calculations and round your answers to the nearest whole dollar amount. (e. g., 32))Scenario-1Debt issue: Cash flows 40-hour week $ 50-hour week $ Scenario-2Equity issue: Cash flows 40-hour week $ 50-hour week $ b. Under which form of financing is Tom likely to work harder?Debt issueEquity issue

Answers: 3

Another question on Business

Business, 22.06.2019 19:30

Which of the following businesses is most likely to disrupt an existing industry? a. closer connex developed an earphone that receives emails and text messages and converts them to voice messages. the first models had poor reception, but they rapidly improved over time. b. mega technologies reconfigured the components used in its touchscreen tablets to create a new type of wearable device for use in restaurants and other service industries. c. particle inc. developed a teleportation technology that can transport physical materials instantaneously across great distances. d. altrea added advanced camera technology to its premium line of smartphones so that they would take the highest-quality photos of all phones on the market.

Answers: 1

Business, 22.06.2019 19:50

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

Business, 22.06.2019 20:00

Which of the following is a competitive benefit experienced by the first mover firm in an industry? a. the first mover will be able to achieve a less steep learning curve. b. the first mover will be able to reduce the switching costs. c. the first mover will not have to patent its products or technology. d. the first mover will be able to reduce costs through economies of scale.

Answers: 3

Business, 22.06.2019 22:20

Who owns a renter-occupied apartment? a. the government b. a landlord c. the resident d. a cooperative

Answers: 1

You know the right answer?

Tom Scott is the owner, president, and primary salesperson for Scott Manufacturing. Because of this,...

Questions

Chemistry, 05.05.2021 07:20

Physics, 05.05.2021 07:20

Biology, 05.05.2021 07:20

Mathematics, 05.05.2021 07:20

Mathematics, 05.05.2021 07:20

Physics, 05.05.2021 07:20

Mathematics, 05.05.2021 07:20

Spanish, 05.05.2021 07:20

Mathematics, 05.05.2021 07:20