Business, 16.04.2020 04:33 chrisraptorofficial

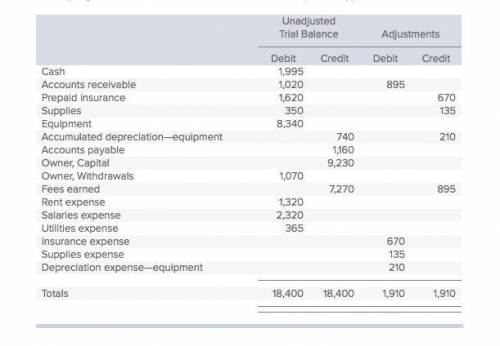

A company's december 31 work sheet for the current period appears below. based on the information provided, what is net income for the current period? unadjusted trial balance adjustments debit credit debit credit cash 2,145 accounts receivable 1,170 1,045 prepaid insurance 1,770 820 supplies 500 285 equipment 8,490 accumulated depreciation—equipment 890 360 accounts payable 1,310 owner, capital 10,130 owner, withdrawals 1,220 fees earned 7,420 1,045 rent expense 1,470 salaries expense 2,470 utilities expense 515 insurance expense 820 supplies expense 285 depreciation expense—equipment 360 totals 19,750 19,750 2,510 2,510

Answers: 3

Another question on Business

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

Business, 23.06.2019 15:30

Bill is 31 years old, married, and lived with his spouse michelle from january 2018 to september 2018. bill paid all the cost of keeping up his home. he indicated that he is not legally separated and he and michelle agreed they will not a file a joint return. bill has an 8-year-old son, daniel, who qualifies as bill's dependent. bill worked as a clerk and his wages are $20,000 for 2018. his income tax before credits is $500. in 2018, he took a computer class at the local university to improve his job skills. bill has a receipt showing he paid $1,200 for tuition. he paid for all his educational expenses and did not receive any assistance or reimbursement. bill does not have enough deductions to itemize. bill, michelle, and daniel are u.s. citizens with valid social security numbers. 8. bill does not qualify to claim which of the following: a. head of household b. education benefit c. earned income credit d. all of the above

Answers: 3

You know the right answer?

A company's december 31 work sheet for the current period appears below. based on the information pr...

Questions

Mathematics, 17.12.2020 06:50

Computers and Technology, 17.12.2020 06:50

Mathematics, 17.12.2020 06:50

World Languages, 17.12.2020 06:50

Mathematics, 17.12.2020 06:50

Biology, 17.12.2020 06:50

Chemistry, 17.12.2020 06:50

English, 17.12.2020 06:50

Health, 17.12.2020 06:50