Business, 27.05.2020 22:07 koreanrice101

The Money Pit Mortgage Company is interested in monitoring the performance of the mortgage process. Fifteen samples of five completed mortgage transactions each were taken during a period when the process was believed to be in control. The times to complete the transactions were measured. The means and ranges of the mortgage process transaction times, measured in days, are as follows:

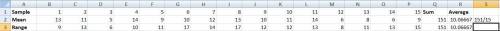

sample 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

mean 13 11 5 14 9 10 12 13 10 11 14 6 8 6 9

range 9 13 6 10 11 17 14 17 12 12 13 8 11 13 15

Subsequently, samples of size 5 were taken from the process every week for the next 10 weeks. The times were measured and the following results obtained:

Sample 16 17 18 19 20 21 22 23 24 25

mean 9 11 6 12 14 15 10 19 17 15

range 9 13 8 6 14 15 13 12 10 8

Factors for calculating three-sigma limits for the

x overbarx-chart and R-chart

Size of Sample (n)

Factor for UCL and LCL for

x overbarx-chart

(Upper A 2A2)

Factor for LCL for R-Chart

(Upper D 3D3)

Factor for UCL for R-Chart

(Upper D 4D4)

2 1.8801.880 00 3.2673.267

3 1.0231.023 00 2.5752.575

4 0.7290.729 00 2.2822.282

5 0.5770.577 00 2.1152.115

6 0.4830.483 00 2.0042.004

7 0.4190.419 0.0760.076 1.9241.924

8 0.3730.373 0.1360.136 1.8641.864

9 0.3370.337 0.1840.184 1.8161.816

10 0.3080.308 0.2230.223 1.7771.777

Construct the control charts for the mean and the range, using the original 15 samples.

Set up the R-chart by specifying the center line andthree-sigma control limits below. (Enter your responses rounded to two decimal places.)

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

Which of the following explains why the government sets a required reserve ratio for private banks? a. to allow the government to control the interest rate charged on loans. b. to prevent banks from printing too much money and causing inflation. c. to make sure banks don't run out of money when customers make withdrawals. d. to enable the regulation of risk levels in the decision process of offering loans. 2b2t

Answers: 1

Business, 22.06.2019 04:30

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 08:30

Conor is 21 years old and just started working after college. he has opened a retirement account that pays 2.5% interest compounded monthly. he plans on making monthly deposits of $200. how much will he have in the account when he reaches 591 years of age?

Answers: 2

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

The Money Pit Mortgage Company is interested in monitoring the performance of the mortgage process....

Questions

English, 11.07.2019 07:30

Mathematics, 11.07.2019 07:30

English, 11.07.2019 07:30

Chemistry, 11.07.2019 07:30

History, 11.07.2019 07:30

Mathematics, 11.07.2019 07:30

Chemistry, 11.07.2019 07:30

Mathematics, 11.07.2019 07:30

Mathematics, 11.07.2019 07:30