Business, 02.06.2020 11:58 irenemonte

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows:

Sales $ 6,200,000

Variable costs (50% of sales) 3,100,000

Fixed costs 1,920,000

Earnings before interest and taxes (EBIT) $ 1,180,000

Interest (10% cost) 440,000

Earnings before taxes (EBT) $ 740,000

Tax (30%) 222,000

Earnings after taxes (EAT) $ 518,000

Shares of common stock 320,000

Earnings per share $ 1.62

The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $3.2 million in additional financing. His investment banker has laid out three plans for him to consider:

Sell $3.2 million of debt at 14 percent.

Sell $3.2 million of common stock at $20 per share.

Sell $1.60 million of debt at 13 percent and $1.60 million of common stock at $25 per share.

Variable costs are expected to stay at 50 percent of sales, while fixed expenses will increase to $2,420,000 per year. Delsing is not sure how much this expansion will add to sales, but he estimates that sales will rise by $1.60 million per year for the next five years.

Delsing is interested in a thorough analysis of his expansion plans and methods of financing. He would like you to analyze the following:

Required:

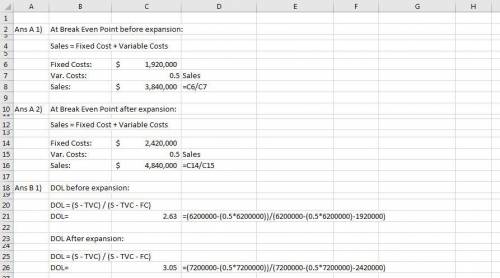

a. The break-even point for operating expenses before and after expansion (in sales dollars). (Enter your answers in dollars not in millions, i. e, $1,234,567.)

b. The degree of operating leverage before and after expansion. Assume sales of $6.2 million before expansion and $7.2 million after expansion. Use the formula: DOL = (S − TVC) / (S − TVC − FC). (Round your answers to 2 decimal places.)

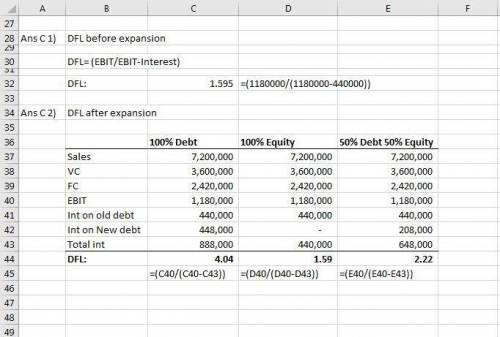

c-1. The degree of financial leverage before expansion. (Round your answers to 2 decimal places.)

c-2. The degree of financial leverage for all three methods after expansion. Assume sales of $7.2 million for this question. (Round your answers to 2 decimal places.)

d. Compute EPS under all three methods of financing the expansion at $7.2 million in sales (first year) and $10.1 million in sales (last year). (Round your answers to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 14:40

Increases in output and increases in the inflation rate have been linked to

Answers: 2

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 16:10

The following are line items from the horizontal analysis of an income statement:increase/ (decrease) increase/ (decrease) 2017 2016 amount percent fees earned $120,000 $100,000 $20,000 20% wages expense 50,000 40,000 10,000 25 supplies expense 2,000 1,700 300 15 which of the items is stated incorrectly? a. fees earned b. supplies expense c. none of these choices are correct. d. wages expense

Answers: 3

Business, 22.06.2019 20:40

Which of the following is true concerning the 5/5 lapse rule? a) the 5/5 lapse rule deems that a taxable gift has been made where a power to withdraw in excess of $5,000 or five percent of the trust assets is lapsed by the powerholder. b) the 5/5 lapse rule only comes into play with a single beneficiary trust. c) amounts that lapse under the 5/5 lapse rule qualify for the annual exclusion. d) gifts over the 5/5 lapse rule do not have to be disclosed on a gift tax return.

Answers: 1

You know the right answer?

Delsing Canning Company is considering an expansion of its facilities. Its current income statement...

Questions

Social Studies, 11.02.2020 05:32

Business, 11.02.2020 05:32

Mathematics, 11.02.2020 05:32