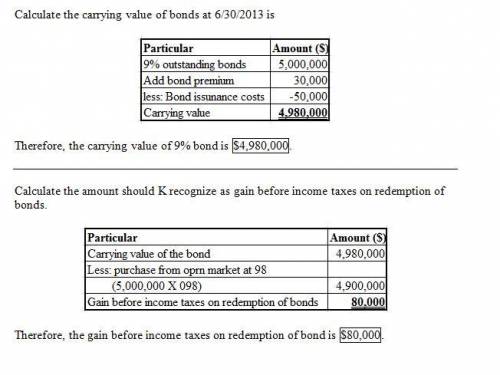

On June 30, Year 7, King Co. had outstanding 9%, $5,000,000 face value bonds maturing on June 30, Year 9. Interest was payable semiannually every June 30 and December 31. On June 30, Year 7, after amortization was recorded for the period, the unamortized bond premium was $30,000. On that date, King acquired all its outstanding bonds on the open market at 93 and retired them. At June 30, Year 7, what amount should King recognize as gain before income taxes on redemption of bonds

Answers: 2

Another question on Business

Business, 21.06.2019 16:30

ernst's electrical has a bond issue outstanding with ten years to maturity. these bonds have a $1,000 face value, a 5 percent coupon, and pay interest semiminusannually. the bonds are currently quoted at 96 percent of face value. what is ernst's pretax cost of debt?

Answers: 1

Business, 22.06.2019 07:00

For the past six years, the price of slippery rock stock has been increasing at a rate of 8.21 percent a year. currently, the stock is priced at $43.40 a share and has a required return of 11.65 percent. what is the dividend yield? 3.20 percent 2.75 percent 3.69 percent

Answers: 3

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 17:30

You should do all of the following before a job interview except

Answers: 2

You know the right answer?

On June 30, Year 7, King Co. had outstanding 9%, $5,000,000 face value bonds maturing on June 30, Ye...

Questions

Computers and Technology, 29.08.2020 23:01

Mathematics, 29.08.2020 23:01

English, 29.08.2020 23:01

Mathematics, 29.08.2020 23:01

Mathematics, 29.08.2020 23:01

Chemistry, 29.08.2020 23:01