Business, 20.09.2020 16:01 tntaylor862

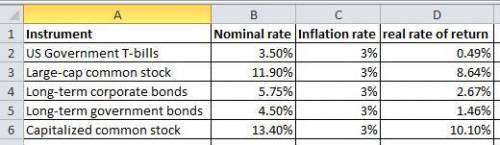

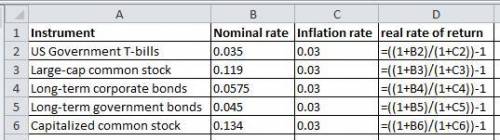

You are given the following long-run annual rates of return for alternative investment instruments: U. S. Government T-bills 3.50 % Large-cap common stock 11.90 Long-term corporate bonds 5.75 Long-term government bonds 4.50 Small-capitalization common stock 13.40 The annual rate of inflation during this period was 3 percent. Compute the real rate of return on these investment alternatives. Do not round intermediate calculations. Round your answers to two decimal places. Real Rate of Return U. S. Government T-bills: % Large-cap common stock: % Long-term corporate bonds: % Long-term government bonds: % Small-capitalization common stock: %

Answers: 1

Another question on Business

Business, 22.06.2019 10:30

What type of budget is stated? a budget is a type of financial report that scrutinizes the inflow and outflow of money in a given financial year.

Answers: 1

Business, 22.06.2019 20:30

Before the tools that have come from computational psychiatry are ready to be used in everyday practice by psychiatrics, what is needed

Answers: 1

Business, 22.06.2019 23:00

How an absolute advantage might affect a country's imports and exports?

Answers: 2

Business, 23.06.2019 05:30

What is a potential negative effect of an expansionary policy? decreased borrowing increased interest rates increased inflation decreased available credit

Answers: 1

You know the right answer?

You are given the following long-run annual rates of return for alternative investment instruments:...

Questions

History, 28.10.2019 15:31

Mathematics, 28.10.2019 15:31

Mathematics, 28.10.2019 15:31

Health, 28.10.2019 15:31

Mathematics, 28.10.2019 15:31

English, 28.10.2019 15:31

Arts, 28.10.2019 15:31

Mathematics, 28.10.2019 15:31

Mathematics, 28.10.2019 15:31