Business, 03.11.2020 16:50 Kbkbkb3710

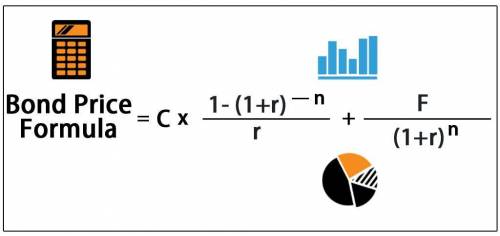

Consider two bonds, a 3-year bond paying an annual coupon of 5% and a 10-year bond also with an annual coupon of 5%. Both currently sell at a face value of $1,000. Now suppose interest rates rise to 10%. a. What is the new price of the 3-year bonds

Answers: 2

Another question on Business

Business, 21.06.2019 17:10

All else being equal, which is true about a firm with high operating leverage relative to a firm with low operating leverage? select one: a. a higher percentage of the high operating leverage firm's costs are fixed. b. the high operating leverage firm is exposed to less risk. c. the debt payments limit the high operating leverage firm's opportunities to turn a big profit. d. the high operating leverage firm has more debt.

Answers: 2

Business, 22.06.2019 08:30

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 20:00

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

Business, 22.06.2019 20:00

An arithmetic progression involves the addition of the same quantity to each number.which might represent the arithmetic growth of agricultural production

Answers: 3

You know the right answer?

Consider two bonds, a 3-year bond paying an annual coupon of 5% and a 10-year bond also with an annu...

Questions

Mathematics, 14.12.2020 01:00

English, 14.12.2020 01:00

Mathematics, 14.12.2020 01:00

Physics, 14.12.2020 01:00

English, 14.12.2020 01:00

Mathematics, 14.12.2020 01:00

Spanish, 14.12.2020 01:00