NET PAY

$667.17

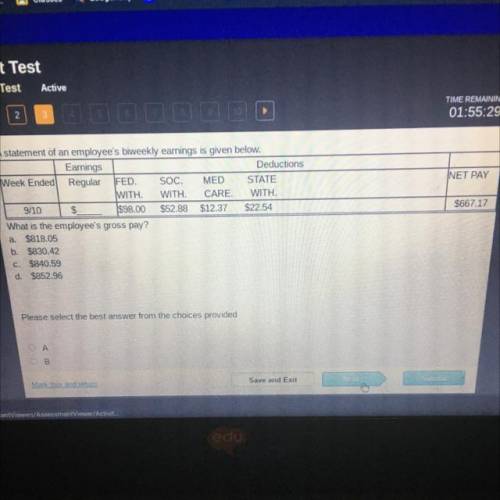

A statement of an employee's biweekly earnings is given below.

Earnings...

Business, 10.12.2020 03:00 phancharamachasm

NET PAY

$667.17

A statement of an employee's biweekly earnings is given below.

Earnings

Deductions

Week Ended Regular FED. SOC. MED STATE

WITH. WITH. CARE WITH

9/10 $ $98.00 $52.88 $12.37 $22.54

What is the employee's gross pay?

a $818.05

b. $830.42

C. 5840.59

d. $852.96

Answers: 2

Another question on Business

Business, 22.06.2019 05:50

Acompany that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. prior to buying the new equipment, the company used 6 workers, who produced an average of 79 carts per hour. workers receive $16 per hour, and machine coast was $49 per hour. with the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $11 per hour while output increased by four carts per hour. a) compute the multifactor productivity (mfp) (labor plus equipment) under the prior to buying the new equipment. the mfp (carts/$) = (round to 4 decimal places). b) compute the productivity changes between the prior to and after buying the new equipment. the productivity growth = % (round to 2 decimal places)

Answers: 3

Business, 22.06.2019 09:30

Which are the best examples of costs that should be considered when creating a project budget?

Answers: 2

Business, 23.06.2019 02:10

Which of the following best describes what production accomplishes? a. efficient use of natural resources. b. a reduction in the size of the labor force. c. an increase in supply that lowers prices. d. value added to resources that already exist.

Answers: 1

Business, 23.06.2019 12:30

Mason farms purchased a building for $689,000 eight years ago. six years ago, repairs costing $136,000 were made to the building. the annual taxes on the property are $11,000. the building has a current market value of $840,000 and a current book value of $494,000. the building is totally paid for and solely owned by the firm. if the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building? $0$582,000$840,000$865,000$953,000

Answers: 3

You know the right answer?

Questions

Physics, 02.03.2021 03:50

Mathematics, 02.03.2021 03:50

Mathematics, 02.03.2021 03:50

Arts, 02.03.2021 03:50

Spanish, 02.03.2021 03:50

Mathematics, 02.03.2021 03:50

Biology, 02.03.2021 03:50

Mathematics, 02.03.2021 03:50

Mathematics, 02.03.2021 03:50

Mathematics, 02.03.2021 03:50