Business, 16.02.2021 04:20 lopezma152

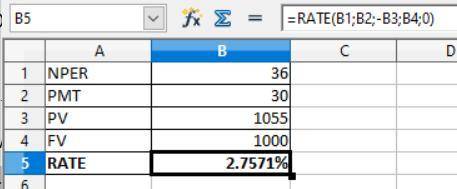

Baxter Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds on the market that sell for $1,055, make semiannual payments, and mature in 18 years. Both bonds have a par value of $1,000. What coupon rate should the company set on its new bonds if it wants them to sell at par

Answers: 2

Another question on Business

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 22.06.2019 20:00

The master manufacturing company has just announced a tender offer for its own common stock. master is offering to buy up to 100% of the company's stock at $20 per share contingent on at least 64% of the outstanding shares being tendered. after the announcement of the offer, the stock closed on the nyse up 2.50 at $18.75. a customer has 100 shares of master stock in his cash account. the customer tells you that he wishes to "cash out" his position. you should recommend that the customer:

Answers: 2

Business, 23.06.2019 03:00

If joe to go decides to produce its coffee beans domestically and sell them in india through a local retailer, this would be an example of

Answers: 2

You know the right answer?

Baxter Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company cur...

Questions

Mathematics, 30.11.2021 03:30

Mathematics, 30.11.2021 03:30

Mathematics, 30.11.2021 03:30

English, 30.11.2021 03:30

Mathematics, 30.11.2021 03:30

Health, 30.11.2021 03:30

Mathematics, 30.11.2021 03:30

Mathematics, 30.11.2021 03:30