Business, 08.03.2021 20:00 sherlyngaspar1p9t3ly

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company can offer competitive prices due to volume buying and requires an Interest rate Implicit In the lease that is one percent below alternate methods of financing. On September 30, 2018, the company leased a delivery truck to a local florist, Anything Grows.

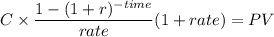

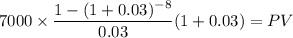

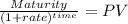

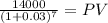

The lease agreement specified quarterly payments of $7,000 beginning September 30, 2018, the beginning of the lease, and each quarter (December 31, March 31, and June 30) through June 30, 2021 (three-year lease term). The florist had the option to purchase the truck on September 29, 2020, for $14,000 when It was expected to have a residual value of $14,000. The estimated useful life of the truck is four years. Mid-South Auto Leasing's quarterly interest rate for determining payments was 3% (approximately 12% annually). Mid-South paid $56,000 for the truck. Both companies use straight-line depreciation or amortization. Anything Grows' Incremental Interest rate is 12%. int: A leasing term ends for accounting purposes when an option becomes exercisable if It's expected to be exercised (L. e., a BPO). (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.)

Required:

1. Calculate the amount of selling profit that Mid-South would recognize In this sales-type lease. (Be careful to note that, although payments occur on the last calendar day of each quarter since the first payment was at the beginning of the lease, payments represent an annuity due.)

2. Prepare the appropriate entries for Anything Grows and Mid-South on September 30, 2018.

3. Prepare an amortization schedule(s) describing the pattern of Interest expense for Anything Grows and Interest revenue for Mid- South Auto Leasing over the lease term.

4. Prepare the appropriate entries for Anything Grows and Mid-South Auto Leasing on December 31, 2018.

5. Prepare the appropriate entries for Anything Grows and Mid-South on September 29, 2020, assuming the purchase option was exercised on that date.

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

Consider the following ethical argument. which of the three statements represents the moral statement about a moral principle? statement 1: a dealership advertised a car at a very low price, but only had a similar higher priced model in stock. statement 2: it is wrong to perform a bait and switch. statement 3: the dealership was wrong to advertise the car on special sale when in actually it was not available.

Answers: 3

Business, 22.06.2019 02:30

Consider how health insurance affects the quantity of health care services performed. suppose that the typical medical procedure has a cost of $160, yet a person with health insurance pays only $40 out of pocket. her insurance company pays the remaining $120. (the insurance company recoups the $120 through premiums, but the premium a person pays does not depend on how many procedures that person chooses to undergo.) consider the following demand curve in the market for medical care. use the black point (plus symbol) to indicate the quantity of procedures demanded if each procedure has a price of $160. then use the grey point (star symbol) to indicate the quantity of procedures demanded if each procedure has a price of $40. q d at p=$160 q d at p=$40 0 10 20 30 40 50 60 70 80 90 100 200 180 160 140 120 100 80 60 40 20 0 price of medical procedures quantity of medical procedures demand if the cost of each procedure to society is truly $160, the quantity that maximizes total surplus is procedures. economists often blame the health insurance system for excessive use of medical care. given your analysis, the use of care might be viewed as excessive because consumers get procedures whose value is than the cost of producing them.

Answers: 1

Business, 22.06.2019 04:30

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 11:40

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

You know the right answer?

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company...

Questions

Mathematics, 11.06.2021 16:00

Mathematics, 11.06.2021 16:00

Mathematics, 11.06.2021 16:00

History, 11.06.2021 16:00

Mathematics, 11.06.2021 16:00

History, 11.06.2021 16:00

Mathematics, 11.06.2021 16:10

Mathematics, 11.06.2021 16:10

Chemistry, 11.06.2021 16:10

History, 11.06.2021 16:10

![\left[\begin{array}{cccccc}$Time&$Beg&$Cuota&$Interes&$Amort&$Ending\\0&61995.26&7000&&7000&54995.26\\1&54995.26&7000&1649.86&5350.14&49645.12\\2&49645.12&7000&1489.35&5510.65&44134.47\\3&44134.47&7000&1324.03&5675.97&38458.5\\4&38458.5&7000&1153.76&5846.24&32612.26\\5&32612.26&7000&978.37&6021.63&26590.63\\6&26590.63&7000&797.72&6202.28&20388.35\\7&20388.35&21000&611.65&20388.35&0\end{array}\right]](/tpl/images/1177/7088/d425f.png)