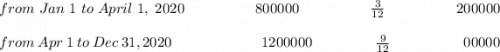

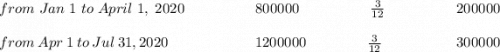

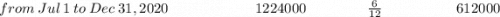

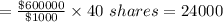

On June 1, 2018, Cheyenne Company and Ayayai Company merged to form Pina Inc. A total of 808,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2020, the company issued an additional 568,000 shares of stock for cash. All 1,376,000 shares were outstanding on December 31, 2020. Pina Inc. also issued $600,000 of 20-year, 7% convertible bonds at par on July 1, 2020. Each $1,000 bond converts to 44 shares of common at any interest date. None of the bonds have been converted to date. Pina Inc. is preparing its annual report for the fiscal year ending December 31, 2020. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,547,000. (The tax rate is 20%.)

Determine the following for 2020.

(a) The number of shares to be used for calculating: (Round answers to 0 decimal places, e. g. $2,500.)

(1) Basic earnings per share enter a number of shares rounded to 0 decimal places shares

(2) Diluted earnings per share enter a number of shares rounded to 0 decimal places shares

(b) The earnings figures to be used for calculating: (Round answers to 0 decimal places, e. g. $2,500.)

(1) Basic earnings per share $enter a dollar amount rounded to 0 decimal places

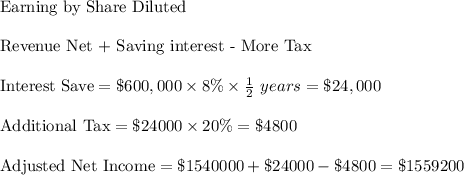

(2) Diluted earnings per share $enter a dollar amount rounded to 0 decimal places

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

Walter wants to deposit $1,500 into a certificate of deposit at the end of each ofthe next 6 years. the deposits will earn 5 percent compound annual interest. ifwalter follows through with his plan, approximately how much will be in his accountimmediately after the sixth deposit is made?

Answers: 1

Business, 22.06.2019 00:00

Which of the following is a disadvantage to choosing a sole proprietorship business structure? question 9 options: the owner has personal responsibility for the company's liabilities. the owner has to share the profits with partners. the owner is still liable for personal debts. the owner has to report to shareholders.

Answers: 1

Business, 22.06.2019 01:00

You are the manager in charge of global operations at bankglobal – a large commercial bank that operates in a number of countries around the world. you must decide whether or not to launch a new advertising campaign in the u.s. market. your accounting department has provided the accompanying statement, which summarizes the financial impact of the advertising campaign on u.s. operations. in addition, you recently received a call from a colleague in charge of foreign operations, and she indicated that her unit would lose $8 million if the u.s. advertising campaign were launched. your goal is to maximize bankglobal’s value. should you launch the new campaign? explain. pre-advertising campaign post-advertising campaign total revenues $18,610,900 $31,980,200 variable cost tv airtime 5,750,350 8,610,400 ad development labor 1,960,580 3,102,450 total variable costs 7,710,930 11,712,850 direct fixed cost depreciation – computer equipment 1,500,000 1,500,000 total direct fixed cost 1,500,000 1,500,000 indirect fixed cost managerial salaries 8,458,100 8,458,100 office supplies 2,003,500 2,003,500 total indirect fixed cost $10,461,600 $10,461,600

Answers: 2

Business, 22.06.2019 11:00

Abank provides its customers mobile applications that significantly simplify traditional banking activities. for example, a customer can use a smartphone to take a picture of a check and electronically deposit into an account. this unique service demonstrates the bank’s desire to practice which one of porter’s strategies?

Answers: 3

You know the right answer?

On June 1, 2018, Cheyenne Company and Ayayai Company merged to form Pina Inc. A total of 808,000 sha...

Questions

Mathematics, 01.02.2020 00:56

Health, 01.02.2020 00:56

History, 01.02.2020 00:56

History, 01.02.2020 00:56

Social Studies, 01.02.2020 00:56

Mathematics, 01.02.2020 00:56

Chemistry, 01.02.2020 00:56