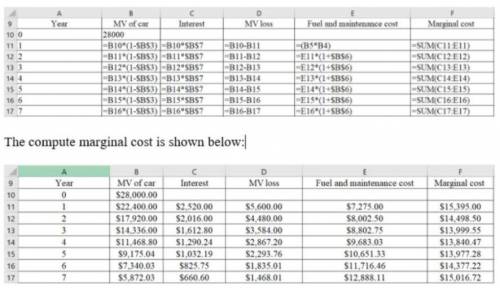

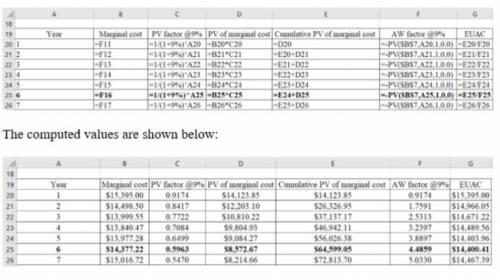

You plan to purchase a car for $28,000. Its market value will decrease by 20% per year. You have determined that the IRS-allowed mileage reimbursement rate for business travel is about right for fuel and maintenance at $0.485 per mile in the 1st year. You anticipate that it will go up at a rate of 10% each year, with the price of oil rising, influencing gasoline, oils, greases, tires, and so on. You normally drive 15,000 miles per year. Your MARR is 9%.

Required:

What is the optimum replacement interval for the car?

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

Down under products, ltd., of australia has budgeted sales of its popular boomerang for the next four months as follows: unit salesapril 74,000may 85,000june 114,000july 92,000the company is now in the process of preparing a production budget for the second quarter. past experience has shown that end-of-month inventory levels must equal 10% of the following month’s unit sales. the inventory at the end of march was 7,400 units.required: prepare a production budget by month and in total, for the second quarter.

Answers: 3

Business, 22.06.2019 17:30

Communication comes in various forms. which of the following is considered an old form of communication? a) e-mail b) letter c) skype d) texting

Answers: 2

Business, 22.06.2019 19:20

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

Business, 22.06.2019 23:10

Amazon inc. does not currently pay a dividend. analysts expect amazon to commence paying annual dividends in three years. the first dividend is expected to be $2 per share. dividends are expected to grow from that point at an annual rate of 4% in perpetuity. investors expect a 12% return from the stock. what should the price of the stock be today?

Answers: 1

You know the right answer?

You plan to purchase a car for $28,000. Its market value will decrease by 20% per year. You have det...

Questions

Computers and Technology, 06.07.2021 21:00

Chemistry, 06.07.2021 21:00

Health, 06.07.2021 21:00

English, 06.07.2021 21:00

Mathematics, 06.07.2021 21:00

Spanish, 06.07.2021 21:00