Mathematics, 20.01.2020 17:31 punkee5375

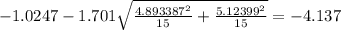

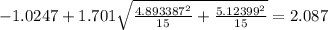

An investor believes that investing in domestic and international stocks will give a difference in the mean rate of return. they take two random samples of 15 months over the past 30 years and find the following rates of return from a selection of domestic (group 1) and international (group 2) investments. can they conclude that there is a difference at the 0.10 level of significance? assume the data is normally distributed with unequal variances. use a confidence interval method. round to 3 decimal places. average group 1 = 2.0233, sd group 1 = 4.893387, n1 = 15 average group 2 = 3.048, sd group 2 = 5.12399, n2 = 15

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:00

Acircular hot tub located near the middle of a rectangular patio has a diameter of 48 inches. the patio measures 11 feet by 6 feet. what is the area of the patio that is not covered by the hot tub?

Answers: 1

Mathematics, 21.06.2019 16:00

Determine the volume of a cylinder bucket if the diameter is 8.5 in. and the height is 11.5 in.

Answers: 1

Mathematics, 21.06.2019 20:00

Put the equation in slope intercept form by solving for y

Answers: 2

You know the right answer?

An investor believes that investing in domestic and international stocks will give a difference in t...

Questions

Mathematics, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

Biology, 13.07.2019 01:30

History, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

Physics, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

Mathematics, 13.07.2019 01:30

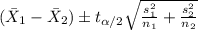

represent the sample mean 1

represent the sample mean 1  represent the sample mean 2

represent the sample mean 2  population sample deviation for sample 1

population sample deviation for sample 1  population sample deviation for sample 2

population sample deviation for sample 2  parameter of interest at 0.1 of significance so the confidence would be 0.9 or 90%

parameter of interest at 0.1 of significance so the confidence would be 0.9 or 90%

(1)

(1)

and

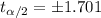

and  , and we can use excel, a calculator or a table to find the critical value. The excel command would be: "=-T.INV(0.05,28)".And we see that

, and we can use excel, a calculator or a table to find the critical value. The excel command would be: "=-T.INV(0.05,28)".And we see that