Mathematics, 20.02.2020 01:03 elvira18

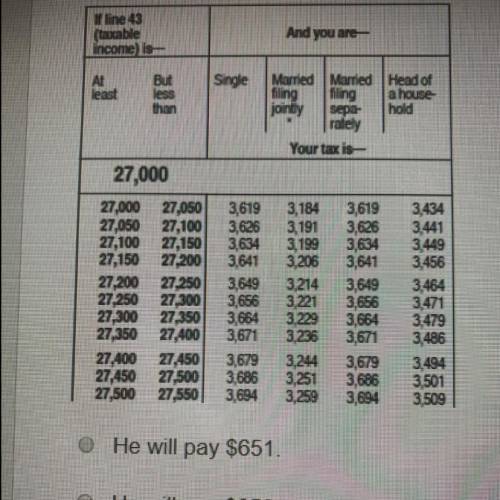

Peter's taxable income is $27,314. He is filing as single, and he has already paid $3005 in federal

taxes.

What will he receive or pay after he figures his taxes for the year?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:00

High schoolmathematics 5 points keith is the leading goal scorer for a team in an ice hockey league. last season, he scored 42 goals in 82 games. assuming he scores goals at a constant rate, what is the slope of the line that represents this relationship if the number of games is along the x-axis and the number of goals is along the y-axis?

Answers: 1

Mathematics, 21.06.2019 18:00

Marla bought a book for $12.95, a binder for $3.49, and a backpack for $44.99. the sales tax rate is 6%. find the amount of tax and the total she paid for these items

Answers: 3

Mathematics, 21.06.2019 21:00

Estimate the area under the curve f(x) = 16 - x^2 from x = 0 to x = 3 by using three inscribed (under the curve) rectangles. answer to the nearest integer.

Answers: 1

Mathematics, 21.06.2019 22:30

Avery’s piggy bank has 300 nickels, 450 pennies, and 150 dimes. she randomly picks three coins. each time she picks a coin, she makes a note of it and puts it back into the piggy bank before picking the next coin.

Answers: 1

You know the right answer?

Peter's taxable income is $27,314. He is filing as single, and he has already paid $3005 in federal<...

Questions

Chemistry, 24.03.2020 22:00

Mathematics, 24.03.2020 22:00

Mathematics, 24.03.2020 22:00

History, 24.03.2020 22:00

Advanced Placement (AP), 24.03.2020 22:00

English, 24.03.2020 22:00

Physics, 24.03.2020 22:01

Mathematics, 24.03.2020 22:01

Computers and Technology, 24.03.2020 22:01