According to the Income section shown below from the 1040EZ form, if a

taxpayer filing her fed...

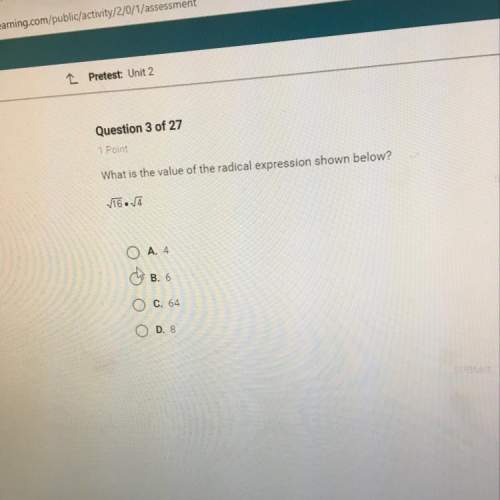

Mathematics, 24.05.2020 00:57 salam6809

According to the Income section shown below from the 1040EZ form, if a

taxpayer filing her federal income tax return using the Single filing status

enters $8900 on line 4 for adjusted gross income, what would she enter on

line 6 for her taxable income? Assume that nobody can claim the taxpayer as

a dependent

-

Wages, salaries and tips. This should be shown in box I of your Form(s) W-2.

Attach your Fom(s) W-2

2

Income

Attach

Form(s) W-2

here

Endose but do

not

attach, any

payment

2

3

Taxable interest. If the total is over $1.300, you cannot use Fonn 1040EZ

Unemployment compensation in excess of S2.400 per recipient and Alaska Permanent

Fund dividends (soc page 11).

3

4

4

You may benefit

from Aling Form

1040A OF 1040

See Before You

Begin on page 4

Add lines 1. 2. und 3. This is your adjusted gross income.

If someone can claim you (or your spouse iſ a joint retum) as a dependent, check

the applicable boxies) below and enter the amount from the worksheet on back.

You

Spouse

3

If no one can claim you or your spouse if a joint return), cater $9,350 if single:

$18.700 if married fling jointly. See back for explanation

Subtract line 5 from line 4. Ir line 5 is larger than line 4. cater

This is your taxable income.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:50

Provide an example of a trigonometric function and describe how it is transformed from the standard trigonometric function f(x) = sin x, f(x) = cos x, or f(x) tan x using key features.

Answers: 3

Mathematics, 21.06.2019 20:30

Write the summation to estimate the area under the curve y = 1 + x2 from x = -1 to x = 2 using 3 rectangles and right endpoints

Answers: 1

Mathematics, 21.06.2019 21:30

Your company withheld $4,463 from your paycheck for taxes. you received a $713 tax refund. select the best answer round to the nearest 100 to estimate how much you paid in taxes.

Answers: 2

You know the right answer?

Questions

Mathematics, 06.05.2020 05:08

Mathematics, 06.05.2020 05:08

Computers and Technology, 06.05.2020 05:08

Mathematics, 06.05.2020 05:08

History, 06.05.2020 05:08

Mathematics, 06.05.2020 05:08

Mathematics, 06.05.2020 05:08