Suppose the personal exemption for Tameka is $3,700 for herself and $3,700 for each

of her 3 c...

Mathematics, 28.05.2020 05:57 hajanaetowens

Suppose the personal exemption for Tameka is $3,700 for herself and $3,700 for each

of her 3 children. How much of her income can be taxed after the exemptions are taken out?

How does this change Tameka’s marginal tax rate? What is her new average tax rate?

How much in taxes does she now owe?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:30

The local farm is advertising a special on fresh picked peaches. the farm charges $4.25 to pick your own peck of peaches and $3.50 for each additional peck you pick. write an equation for the total cost of peaches in terms of the number of pecks. deine your variables. how much does it cost to pick 3 pecks of peaches?

Answers: 3

Mathematics, 21.06.2019 18:00

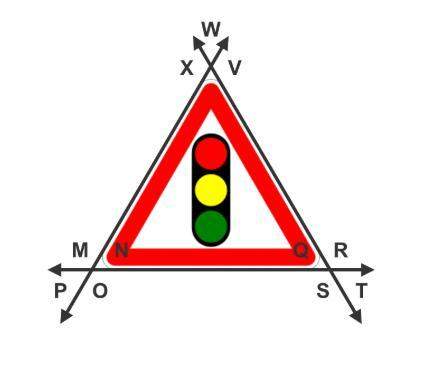

Given: and prove: what is the missing reason in the proof? given transitive property alternate interior angles theorem converse alternate interior angles theorem

Answers: 1

Mathematics, 21.06.2019 23:30

Written as a simplified polynomial in standard form, what is the result when (2x+8)^2(2x+8) 2 is subtracted from 8x^2-38x 2 −3?

Answers: 3

Mathematics, 22.06.2019 04:00

Ineed ! what is the connection between ratios, fractions, and percents? give an example with your answer.

Answers: 2

You know the right answer?

Questions

Arts, 11.03.2020 22:06

Mathematics, 11.03.2020 22:07

Social Studies, 11.03.2020 22:07

Mathematics, 11.03.2020 22:07

Business, 11.03.2020 22:07

History, 11.03.2020 22:07

Business, 11.03.2020 22:07