Mathematics, 22.09.2020 16:01 lliaaaa

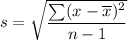

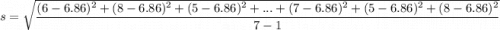

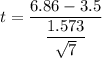

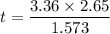

The bad debt ratio for a financial institution is defined to the dollar value of loans defaulted divided by the total dollar value of all loans made. Suppose that a random sample of 7 Ohio banks is selected and that the bad debt ratios (written as percentages) for these banks are 6%, 8%, 5%, 9%, 7%, 5% and 8%. Banking officials claim that the mean debt ratio for all Midwestern banks is 3.5 percent and the mean bad debt ratio for Ohio banks is higher. Set up the null and alternative hypotheses needed to attempt to provide evidence supporting the claim that the mean bad debt ratio for Ohio banks exceed 3.5 percent. (a) H0: μ ≤ [ Select ] % versus Ha: μ > [ Select ] %. (b) Discuss the meanings of a Type I error and a Type II error in this situation. Type I : Conclude that Ohio's mean debt ratio is [ Select ] 3.5 % when it actually is 3.5%. Type II : Conclude that Ohio's mean debt ratio is [ Select ] 3.5 % when it actually is 3.5%.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 23:40

In the diagram, a building cast a 35-ft shadow and a flagpole casts an 8-ft shadow. if the the flagpole is 18 ft tall, how tall is the building? round the the nearest tenth.

Answers: 2

Mathematics, 22.06.2019 03:00

Your friend, taylor, missed class today and needs some identifying solutions to systems. explain to taylor how to find the solution(s) of any system using its graph.

Answers: 1

Mathematics, 22.06.2019 04:30

7x^2-9x+5=0 find the discriminant and number of real solutions

Answers: 1

Mathematics, 22.06.2019 05:10

In triangle abc, w is the centroid and be = 9. find bw. a. 3 b. 6 c. 9 d. 18

Answers: 2

You know the right answer?

The bad debt ratio for a financial institution is defined to the dollar value of loans defaulted div...

Questions

History, 01.10.2019 00:00

History, 01.10.2019 00:00

Social Studies, 01.10.2019 00:00

Mathematics, 01.10.2019 00:00

History, 01.10.2019 00:00

Mathematics, 01.10.2019 00:00

= 6.86

= 6.86

, we reject the null hypothesis and conclude that the claim that the mean bad debt ratio for Ohio banks is higher than the mean for all financial institutions is true.

, we reject the null hypothesis and conclude that the claim that the mean bad debt ratio for Ohio banks is higher than the mean for all financial institutions is true.