Mathematics, 04.01.2022 14:30 jerry546

Social Security tax that is 6.2% of his gross pay Medicare tax that is 1.45% of his gross pay state tax that is 19% of his federal tax Determine how Luis’ net pay will be affected if he increases his federal withholding allowances from 2 to 3. a. His net pay will decrease by $19.00. b. His net pay will increase by $19.00. c. His net pay will decrease by $22.61. d. His net pay will increase by $22.61.

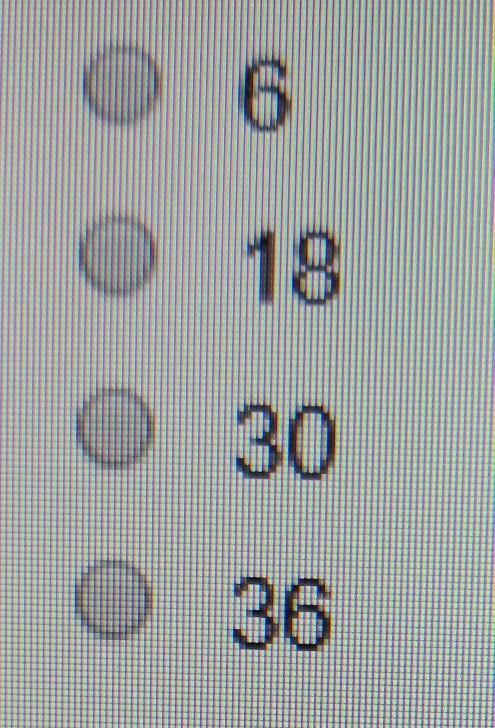

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:50

Which translation maps the vertex of the graph of the function f(x) = x2 onto the vertex of the function g(x) = x2 – 10x +2?

Answers: 1

Mathematics, 21.06.2019 19:10

Find the roots of the polynomial function f(x) = x^3 + 2x^2 + x

Answers: 2

Mathematics, 21.06.2019 22:00

Consider the triangle. which shows the order of the angles from smallest to largest? angle a, angle b, angle c angle b, angle a, angle c angle b, angle c, angle a angle c, angle a, angle b

Answers: 3

You know the right answer?

Social Security tax that is 6.2% of his gross pay Medicare tax that is 1.45% of his gross pay state...

Questions

Mathematics, 29.07.2020 01:01

Biology, 29.07.2020 01:01