Business, 26.09.2019 19:10 genyjoannerubiera

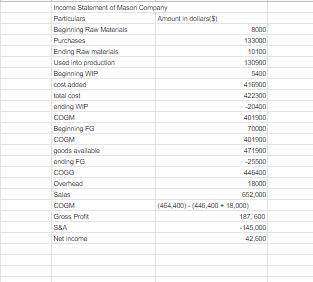

The following data from the just completed year are taken from the accounting records of mason company: sales $ 652,000 direct labor cost $ 81,000 raw material purchases $ 133,000 selling expenses $ 102,000 administrative expenses $ 43,000 manufacturing overhead applied to work in process $ 205,000 actual manufacturing overhead costs $ 223,000 inventories beginning ending raw materials $ 8,000 $ 10,100 work in process $ 5,400 $ 20,400 finished goods $ 70,000 $ 25,500 required: 1. prepare a schedule of cost of goods manufactured. assume all raw materials used in production were direct materials. 2. prepare a schedule of cost of goods sold. assume that the company's underapplied or overapplied overhead is closed to cost of goods sold. 3. prepare an income statement.

Answers: 3

Another question on Business

Business, 21.06.2019 17:40

Steffi is reviewing various licenses and their uses. match the licenses to their respective uses.

Answers: 3

Business, 22.06.2019 11:50

Christopher kim, cfa, is a banker with batts brothers, an investment banking firm. kim follows the energy industry and has frequent contact with industry executives. kim is contacted by the ceo of a large oil and gas corporation who wants batts brothers to underwrite a secondary offering of the company's stock. the ceo offers kim the opportunity to fly on his private jet to his ranch in texas for an exotic game hunting expedition if kim's firm can complete the underwriting within 90 days. according to cfa institute standards of conduct, kim: a) may accept the offer as long as he discloses the offer to batts brothers.b) may not accept the offer because it is considered lavish entertainment.c) must obtain written consent from batts brothers before accepting the offer.

Answers: 1

You know the right answer?

The following data from the just completed year are taken from the accounting records of mason compa...

Questions

Computers and Technology, 21.09.2019 05:30

Health, 21.09.2019 05:30

Computers and Technology, 21.09.2019 05:30

Mathematics, 21.09.2019 05:30